Understanding the Home Buying Process for First-Time Buyers

You’ve spent years scrolling through dreamy home listings, saving Pinterest boards full of interior design ideas, and stalking the latest open house photos. In this guide, we are going to turn those delusions into solutions. Being a first-time home buyer is sometimes nerve-wracking, but this step-by-step guide will explain the process in a way that’s easy to follow.

This guide will also give you some reality checks and not just feed into your delusions of imagining yourself sipping coffee in that perfect breakfast nook; there’s a process to get through. And while it’s not all glamour and instant dream homes, it’s an exciting adventure that will make you feel like a bona fide grown-up. So, buckle up. Let's turn those dreams into reality.

Before you start imagining those housewarming parties, it’s important to get your finances in order. The first thing you need to tackle is understanding how much you can afford to buy a house.

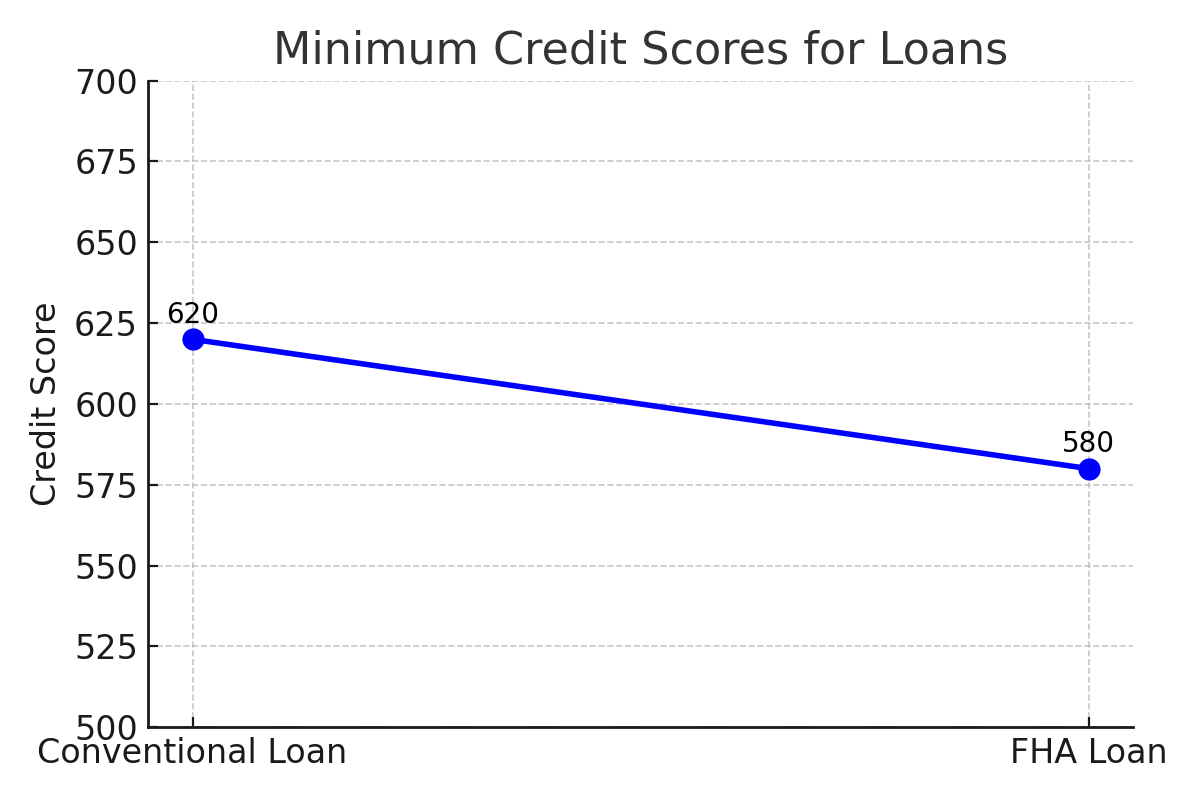

You’ll want to check your credit report before buying a house. Your credit score determines your ability to secure a mortgage loan. A higher credit score generally means better terms and mortgage rates. Most mortgage lenders require minimum credit score requirements to consider you for a loan. A score of 620 or higher is typically required for a conventional loan, but for Federal Housing Administration (FHA)loans, you may qualify with a score as low as 580.

If your credit score isn’t where it needs to be, you can work on building it up before you apply for a mortgage. Consider paying down car or student loans to have a good credit report.

Next, figure out how much house you can afford. This isn’t just about the purchase price and down payment; you’ll also need to consider property taxes, homeowners insurance, and the size of your monthly mortgage payments. Lenders typically use your debt-to-income ratio (DTI) to decide how much they will lend you. They’ll compare your gross monthly income and compare it to your monthly debts, credit card bills, student loans, and the like.

Generally, your DTI should be below 43%, though some loan officers may accept slightly higher ratios depending on the circumstances. Be honest with yourself when calculating your budget, there’s no point in falling in love with a home out of your financial reach.

Now that you know what you can afford, it’s time to consider financing options. Several home loan types are available, each with its advantages and conditions.

Before you can cozy up on your new couch, you must familiarize yourself with the ins and outs of the home-buying process. Think of it as a game of chess: every move matters.

Each decision shapes your path to homeownership, from assessing your credit score to determining the down payment you can afford. You'll need to engage with mortgage lenders, gather your financial documents, and possibly endure awkward conversations about earnest money deposits.

Financing a home can be difficult, but with the right strategies and determination, you’ll be set to make that all-important purchase. Grab your calculator, and let’s embark on this financing journey because that dream home isn't going to buy itself.

FHA loans (Federal Housing Administration loans) are a type of mortgage loan backed by the federal government, specifically for American homebuyers. They are designed to help first-time homebuyers or those with lower credit scores purchase homes by providing more accessible loan terms, such as lower down payment requirements.

In Kenya, however, there are no FHA loans; they are specific to the United States and administered by the U.S. Department of Housing and Urban Development (HUD). Kenya has housing and mortgage programs tailored to the local real estate market and financial systems. Here’s what you can look into for a home loan as a Kenyan homebuyer.

VA loans offered by Veterans Affairs can be an incredible deal if you're a veteran or active-duty service member. These loans often require no minimum down payment, and VA purchase loans tend to have lower interest rates. That’s a massive benefit for those who qualify, helping them save in the long run.

In Kenya, the government has been actively involved in several initiatives to support military veterans and provide housing solutions through public-private partnerships (PPP) and other strategic programs.

The affordable housing project for Kenya Defence Forces (KDF) personnel is a significant initiative. In 2024, the KDF signed a PPP agreement with China Railway Engineering Group to build affordable housing units across five key locations. This project aims to address the housing needs of military personnel and their families by developing homes and associated facilities.

The government has also been focused on improving the welfare of military veterans through several policies. The Military Veterans Act of 2022 established a framework for ensuring veterans' access to benefits such as housing, medical care, and financial support. The act reinforces the commitment to improve the living conditions of retired military personnel, ensuring they have access to dignified post-service life.

A conventional loan is like an investor who believes in your vision. The bank lends you money to buy a house, and in return, you pay them back with interest, much like how an investor expects a return on their investment.

There are two types of investors. A fixed-rate investor expects the same return each month, which is steady and predictable. A variable-rate investor changes their expectations based on the market. Sometimes, they want more, and other times, they want less. Your interest rate can fluctuate depending on the economy.

Just like you need to put some money into starting a business, a down payment is your initial contribution toward buying the house. The loan covers the rest. A start-up takes years to become profitable, just like it takes years to repay a loan fully. But once you’re successful, you’ll fully own your home.

These loans usually have more flexible terms but require at least a 5% down payment. Unlike FHA or VA loans, you won’t need mortgage insurance if you can put down 20%, which will significantly lower your monthly mortgage payment.

Banks and other mortgage lenders provide conventional loans. To qualify, you typically need a down payment of at least 10-20% of the home’s value, depending on the lender. The terms of these loans can vary but generally include repayment periods of up to 25 years.

For example, KCB Bank offers home loans with flexible repayment plans and competitive interest rates.NCBA Bank provides mortgages with up to 90% financing for home purchases. Stanbic Bank Offers mortgage solutions, including refinancing options.

The Kenya Mortgage Refinance Company was established to provide more affordable home financing, particularly for low—and middle-income earners.KMRC can offer long-term, affordable home loans with lower interest rates. These loans typically require a lower down payment and aim to make homeownership more accessible to more Kenyans.

KMRC loans feature lower interest rates for banks and SACCOs, enabling them to offer mortgages at lower rates than conventional loans. The target market is for Kenyans earning less than KSh 150,000 monthly. The repayment period is up to 25 years. Examples of Banks offering KMRC mortgages include KCB Bank, which provides KMRC-backed loans at reduced rates, making homeownership more affordable.HF Group (Housing Finance) also offers KMRC mortgages with up to 90% financing for residential properties.

SACCOs in Kenya offer home loans to their members, often at lower interest rates than traditional banks. If you’re part of a SACCO, this can be a viable and more affordable option for financing your home purchase. SACCOs offer flexibility in loan repayment terms and typically allow for longer repayment periods, often tailored to the specific needs of their members.

Examples of SACCO Home Loans include Stima SACCO, which offers mortgage loans with flexible repayment options for home construction or purchase. Unaitas SACCO also provides home loans for land purchases, home construction, or buying an existing house.

The Kenyan government has launched several initiatives to promote affordable housing. The affordable housing program is part of the Big Four Agenda and aims to provide affordable housing units through partnerships with private developers and financial institutions. The government aims to offer down payment assistance at subsidized rates and financing options for home buyers.

It features lower-priced homes designed for low and middle-income earners. These affordable mortgage options are available through partnerships with banks, SACCOs, and KMRC.

Several Kenyan banks offer Islamic home financing products for those seeking Shariah-compliant financing options. These are structured to avoid interest payments, as interest is prohibited in Islamic finance. Instead, the bank buys the property on behalf of the buyer and then resells it to them at a markup, with payments spread over time.

Examples of banks that offer Shariah-compliant home financing options include Gulf African Bank and First Community Bank.

Some Kenyan banks offer foreign currency mortgages, particularly for expatriates or those earning foreign income. These loans are often denominated in U.S. dollars, British pounds, or euros and are available for residents and non-residents.

For Example, Standard Chartered Bank provides foreign currency home loans for expatriates and non-resident Kenyans.CBA Bank also offers foreign currency mortgage options for properties within Kenya.

Shopping around for a mortgage lender is another one of the most important steps for a first-time home buyer. This is where you meet with a loan officer, ideally a few at various mortgage companies. Each mortgage lender will scrutinize your financial background, such as your debt-to-income ratio.

Before you start house hunting, getting mortgage preapproval from a lender is critical. A loan estimate provided by the lender gives you a clear idea of how much you can borrow. The mortgage pre-approval shows sellers that you’re a serious buyer. You must provide documents like federal income tax returns, pay stubs, and bank statements. Once pre-approved, you’ll receive a preapproval letter, strengthening your bargaining power when making an offer.

Choosing a real estate agent is one of the most essential steps in the home-buying process. A buyer’s agent works specifically for you, helping you navigate the complexities of buying a house. They’ll have insight into the local housing market and can steer you toward the best homes in your price range.

Don’t settle for just anyone; look for a real estate agent who knows luxury. Whether looking for a high-end condo in the city's heart or a sprawling estate in the suburbs, a well-connected agent can make all the difference.

Once you’re financially prepared and preapproved, the fun begins. Here, you can look at listings and tour homes and imagine yourself living in them.

With advancements in technology, touring homes has become easier. Many luxury homes now offer virtual tours, a convenient way to view properties from the comfort of your current residence. However, nothing beats the in-person experience of walking through a home, feeling the space, and imagining how your furniture might look in each room.

When you find "the one," it’s time to make an offer. Your buyer’s agent will help you decide on an appropriate offer price based on the home’s purchase price, its condition, and the market's competitiveness.

Sometimes, you might need to offer more than the asking price to win a bidding war. Once the offer is accepted, you’ll put down an earnest deposit (usually 1-3% of the purchase price), showing the seller you’re serious.

Once your offer is accepted, it’s time for the home inspection and appraisal. The inspection ensures that the home is in good condition, while the assessment determines the home’s appraised value—how much the lender believes the house is worth.

The home inspection is your opportunity to uncover any potential problems with the property. A qualified inspector will examine the home’s foundation, roof, plumbing, and more. If the inspection reveals significant issues, you can renegotiate the purchase price or ask the seller to make repairs.

The lender will require a home appraisal to confirm that the home’s value aligns with the loan amount. If the appraisal comes in lower than the offer price, you may need to negotiate a lower price or pay the difference out of pocket.

After the inspection and appraisal, it’s time for the closing process. This is when all the final paperwork is signed, and ownership of the home transfers from the seller to you.

In addition to your down payment, you’ll also need to budget for closing costs. These typically range from 2-5% of the home’s purchase price and cover fees for the real estate attorney, title search, and more.

Once everything is in order, you’ll receive a closing disclosure detailing the final terms of your loan and all associated costs. Be sure to review it carefully to avoid any surprises.

Your lender may require an escrow account to ensure that your property taxes and homeowners insurance are paid on time. You’ll also need to purchase homeowners insurance before closing. Some buyers opt for additional mortgage insurance, especially if they put less than 20% down.

Congratulations—you’re now a homeowner! But your financial obligations don’t stop at closing. Be sure to stay on top of your mortgage payments, and if your home is part of a community, remember about HOA fees.The term homeowners association (HOA) fees refers to an amount of money that certain types of residential property owners must pay to their homeowners associations every month.

If you’re considering upgrading, consider a home improvement loan. This can help finance major renovations and add more luxury to your new home. Now that you’ve gone through the process of buying a house remember that buying a home is not just a transaction; it’s a lifestyle. Whether you're drawn to the allure of sleek, modern condos or crave the elegance of a sprawling estate, the home-buying process is your gateway to living luxuriously.

When you partner with the right real estate agent, they’ll help you find a property that isn’t just a house but a dream. Luxury is about comfort, prestige, and enjoying every moment in a home that reflects your style.

You’ve finally crossed the finish line, but your journey as a homeowner is just beginning. The real work starts after you’ve settled into your new home. While owning a home offers immense satisfaction, it also comes with responsibilities. Maintenance, upgrades, and managing your finances will all play a role in ensuring your home remains a valuable investment.

One of the first things you’ll need to do post-purchase is rework your budget. Your monthly mortgage payments, property taxes, homeowners insurance, and possibly HOA fees will now be consistent with your monthly expenses.

Beyond these fixed costs, set aside money for ongoing home maintenance. Whether servicing your HVAC system or tending to your landscaping, regular maintenance will save you from expensive repairs in the future.

It’s always wise to have an emergency fund dedicated to home repairs. You don’t want unexpected issues to derail your financial plans, whether a leaking roof or a broken appliance. A good rule of thumb is to set aside at least 1% of your home’s purchase price each year for maintenance and repairs. For example, if your home costs $500,000, budget $5,000 annually for upkeep.

As a homeowner, you might be tempted to start making improvements immediately. But it’s important to prioritize projects that add value. If you’re thinking long-term, focus on upgrades that can increase your home’s resale value. Kitchens, bathrooms, and outdoor spaces offer the highest return on investment. A home improvement loan could be the answer if you need additional financing for major renovations.

Even if you don’t plan to sell your home anytime soon, keeping an eye on the local housing market is essential. Home values fluctuate based on market conditions, and you’ll want to know how your investment performs. Periodically check home sales in your area to understand current property values and trends. If the market heats up, you may sell or refinance to take advantage of lower mortgage rates.

Refinancing your mortgage means replacing your existing loan with a new one, usually at a lower interest rate. This can reduce your monthly payment, freeing up money for other needs. You might also switch from a 30-year loan to a 15-year loan, allowing you to pay off your mortgage faster and save on interest.

Be sure to compare offers from multiple lenders, including traditional banks, credit unions, and online-only nonbank lenders. A loan estimate from each lender will show you the potential savings from refinancing, helping you make an informed decision.

As you pay down your mortgage and your home increases in value, you build equity—this is the portion of the home you truly own. Home equity can be a powerful financial tool, allowing you to borrow money for large expenses, like a home renovation or college tuition. A home equity loan allows you to tap into this resource, but be cautious about borrowing too much and over-leveraging your property.

Owning a home is not just about living comfortably today—it’s also about planning for the future. Whether thinking about growing your family, selling your home for a profit, or making it your forever place, you must consider how your home fits into your long-term goals.

Homeownership is one of the most effective ways to build long-term wealth. Unlike renting, where your money goes to someone else, making monthly mortgage payments builds your equity in the property. As the value of your home appreciates over time, so does your wealth. If the market continues to rise, your home could be worth significantly more than you paid, turning it into a solid investment.

When the time comes to sell your home, timing is key. The real estate market goes through cycles, and knowing when to sell can make a huge difference in your profit. Work closely with a real estate agent specializing in luxury homes to get the best deal when you decide to sell. They’ll have insights into current trends and can help you prepare your home to get the maximum resale value.

The home buying process can seem overwhelming, especially for first-time buyers, but it becomes much clearer by breaking it down into manageable steps. From securing a mortgage loan and finding the perfect real estate agent to making an offer and closing the deal, you’re now armed with the knowledge to make informed decisions.

With the excitement of buying your first home comes a lot of learning. Now that you’ve got the essentials of understanding the home-buying process for first-time buyers, you can step confidently into this new chapter. Your dream home is waiting; all it takes is that first step.

Whether buying a charming starter home or an upscale luxury property, the journey to homeownership is rewarding. Remember, your home is not just a financial investment; it’s where life happens. So, choose wisely, but also enjoy the process.

We’re here to help. As experts in the luxury real estate market, we specialize in finding homes that match your unique style and needs. From the first step of pre-approval to handing over the keys, our team will guide you through every detail. Contact us today if you’re ready to make your home-buying dreams a reality. We’ll help you find a home, a sanctuary where you can live, love, and thrive.

Understanding the home-buying process for first-time buyers is crucial. It involves several steps, starting with assessing your finances, getting a credit report, and then working with a real estate agent to find properties. You'll need to secure a mortgage preapproval from a mortgage lender, identify the right home, make an offer, and navigate the stages of closing costs, home inspection, and a final walk-through before signing the paperwork to close the deal.

The down payment amount depends on the type of loan and the lender. For instance, FHA loans typically require a minimum down payment of 3.5% of the purchase price, whereas conventional loans may require between 5% and 20%. Some loan programs, like VA loans, offer options with zero down payment for eligible veterans. It's important to work with a loan officer to understand your options.

Closing costs are fees for finalizing a real estate transaction, usually 2-5% of the home’s purchase price. These costs include fees for the home appraisal, title search, escrow account setup, loan estimate, and homeowners insurance. Your mortgage lender or real estate attorney can help you estimate the costs.

An FHA loan, backed by the Federal Housing Administration, is a mortgage loan designed to assist first-time home buyers. It allows for lower credit score requirements and smaller down payments than conventional loans, typically requiring a minimum down payment of 3.5%. FHA loans are ideal for buyers with less-than-perfect credit and offer more flexible lending criteria.

Wood, K. (2024b, March 19). How to buy A House: 15 steps in the home buying process. NerdWallet. https://www.nerdwallet.com/article/mortgages/home-buying-checklist-steps-to-buying-house

Dollarhide, M. (2024, September 23). How to buy A House: A step-by-step guide. Investopedia. https://www.investopedia.com/updates/first-time-home-buyer/

Chen, J. (2023, July 22). Homeowners Association (HOA) fee: Meaning, overview and faqs. Investopedia. https://www.investopedia.com/terms/h/homeowners-association-fee-hoa.asp#:~:text=The%20term%20%E2%80%9Chomeowners%20association%20(HOA,their%20homeowners%20associations%20(HOAs).

MAKONG, B. (2024, June 8). Ruto commits to funding additional housing for KDF. Capital News. https://www.capitalfm.co.ke/news/2024/06/ruto-commits-to-funding-additional-housing-for-kdf/

Araj, Victoria. (2024, May 21). How to buy A House: Your step-by-step guide to buying in 2024. Rocket Mortgage. https://www.rocketmortgage.com/learn/how-to-buy-a-house

KCB Bank Kenya, personal banking services, Best Bank in kenya - KCB Kenya website. (2024, June 11). https://ke.kcbgroup.com/