A Guide To The Mortgage Pre-approval Process in Kenya

The pre-approval process follows the mortgage application process. In this step, the lender and the buyer assess the financial situation to determine eligibility and loan approval.

A lender checks the credit financial history using the bank statements submitted. Before the mortgage application process, you can learn how to improve your chances of getting the loan approved. Estimating your borrowing capacity is essential in the pre-approval process.

Mortgage Pre-approval is when the lender sends a pre-approval letter to show you can have a loan offer. This is not a commitment but an offer.

The pre-approval letter includes the following:

Loan Amount: The maximum amount the lender is willing to offer.

Interest Rate: The estimated interest rate, though this may be subject to change.

Mortgage options: The type of mortgage loan (e.g., fixed-rate mortgages, adjustable-rate mortgages).

Expiration Date: The pre-approval expires, usually 60-90 days.

Conditions: Any conditions that must be met before the final approval (e.g., employment history verification, property appraisal).

Borrower’s Information: Your details, such as name and contact information.

Lender’s Information: The lender's name and contact information.

This letter indicates that a lender has reviewed your financial information and will lend you up to a certain amount for a home purchase, subject to final approval.

The difference between mortgage approval and pre-approval is the verification. Mortgage approval is a promise, while the prequalification process is an estimate of the loan.

A mortgage pre-approval does not guarantee a commitment to get the loan. Although, if you provide accurate information, you will likely be qualified for a loan within the pre-approval amount range.

Pre-approval is a vital step in purchasing a house. It allows you to have an estimated budget for the purchase price before you start your property search. A pre-approval letter shows that you are a serious buyer.

The first step in the pre-approval mortgage process is gathering the required documentation. These documents include bank statements, proof of income, pay slips, employment information, tax returns, loan statements, credit scores, and a report.

At this time, one should avoid making big purchases on credit to avoid exceeding the debt-to-income ratio. Having a stable income is favorable when getting a mortgage pre-approval.

Lenders are more comfortable with people who have been employed for a long time than those who have skipped one job to another. If you are self-employed, you must prove that your earnings are consistent and can make monthly payments.

Choosing a mortgage lender is essential before applying for a loan. Explore all the mortgage options before the application. Ensure the lenders are regulated and licensed by the Central Bank of Kenya. Confirm the repayment period, the legal fees, installment amounts, and any late payment penalties.

Good customer service and a flexible repayment period are essential and work to your advantage. Take your time before shopping for homes; there is no rush. Pre-plan yourself and familiarize yourself with the mortgage process. Understand terms used in mortgage loans like interest-only mortgages , mortgage prequalification process, and mortgage rates.

A mortgage broker can help you search for the right mortgage lender. Also, the real estate agent you are working with can inform you of the best mortgage lenders they have worked with in the past.

The lender will require certain documents to determine eligibility for the loan. These documents must be transparent and honest to enable you to get mortgage approval.

Documents supporting your income sources are essential. Recent payslips, usually from the last 2-3 months, are part of the required documents if you are employed. A stable income makes your mortgage approval favorable to the lender.

Self-employed persons will be required to submit a business registration certificate to prove their source of income. Consistent earnings from your business will make the lender acknowledge that you can afford the monthly payments.

A lender assesses your tax returns, usually for the last two years, and bank statements. Showing consistent income deposits is vital in the mortgage pre-approval process.

The Kenya Revenue Authority issues a tax return certificate if one has filed their tax returns and cleared all outstanding tax debt.

An employment letter from your employer confirming your position, salary, and length of employment is needed during the pre-approval process. This further verifies your proof of income. If self-employed, business financial statements and tax returns act as the source of income verification.

Proof of assets is needed to determine your net worth and eligibility. Bank statements, savings, investments, or other assets are essential as they may be used for down payments or closing costs.

A government-issued ID like a passport or national ID card is needed to verify identity.

The lender will typically pull this to assess your credit history and score. A good credit score favors mortgage application approval, while a bad credit score lowers your chances. A solid track record in your valuation report guarantees you an ideal loan.

Document any existing loans, credit cards, or financial obligations. These documents help the lender assess your financial stability and loan eligibility.

A good credit score has many advantages, especially in the pre-approval phase of the mortgage application. You may find it easier to secure mortgage application approval for your dream home. Bad credit, on the other hand, can make it much more difficult.

Knowing the steps you need to take to bring those numbers up can help your credit score and help you attain a good mortgage deal with affordable mortgage payments. Lenders preserve their low interest rates for clients with good credit scores.

Another benefit of having a good credit score is that you are eligible for higher credit limits and more significant loan amounts when applying for a mortgage pre-approval.

A good credit score has the potential to help you qualify to borrow more money than you might be able to otherwise.

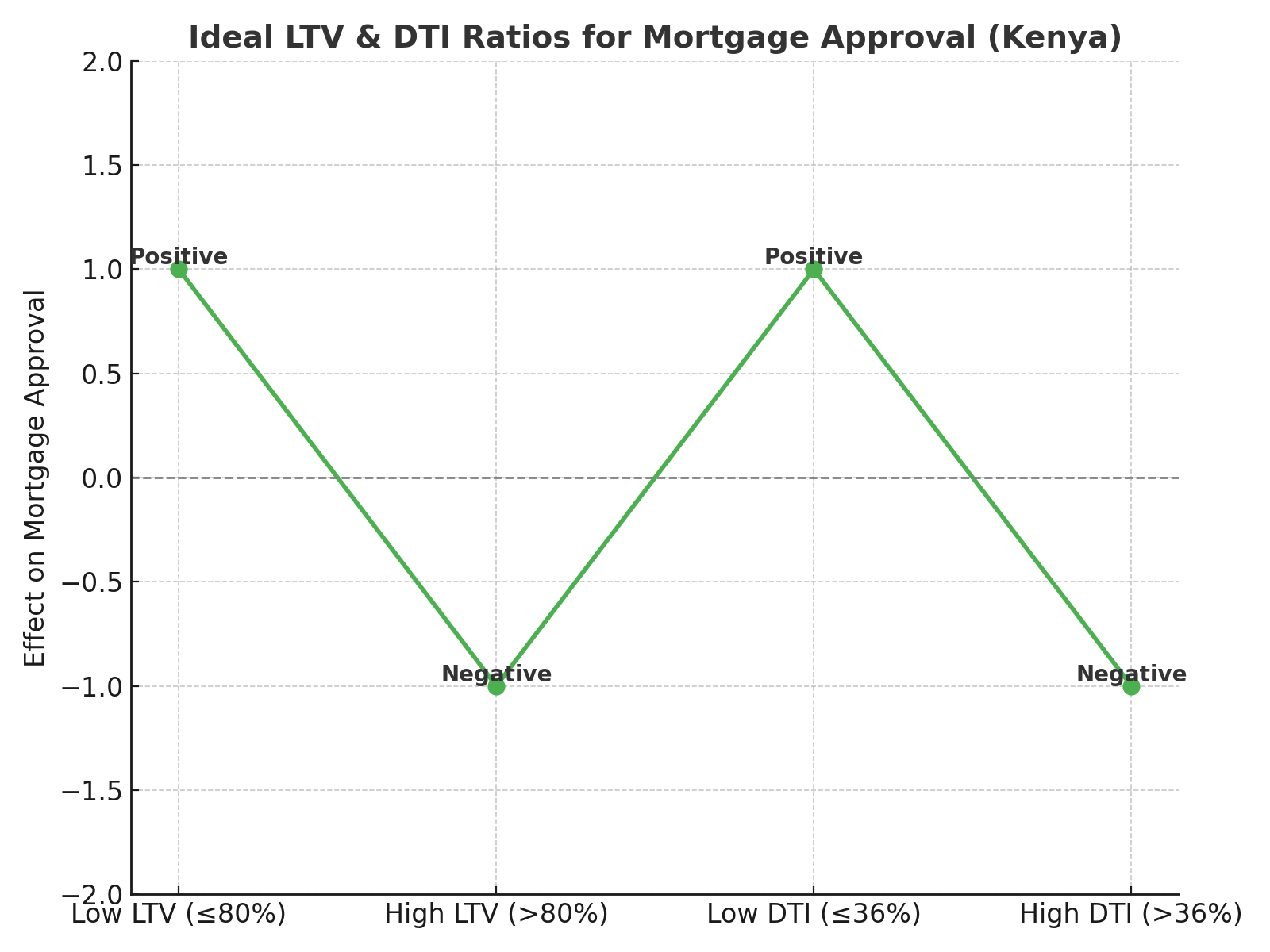

Mortgage pre-approval eligibility is based mainly on two key financial ratios: the Debt-to-Income (DTI) Ratio and the Loan-to-Value (LTV) Ratio.

This measures how much of your gross monthly income goes toward paying debts. Lenders typically prefer a DTI ratio of 36% or lower, although some may accept up to 43% for pre-approval. This includes monthly obligations like credit cards, car loans, and projected monthly payments.

Formula: (Monthly debt payments ÷ Gross monthly income) × 100.

Scenario:

Monthly Gross Income: $5,000

Monthly Debt Payments:

Car Loan: $300

Credit Card Payment: $150

Student Loan Payment: $200

Expected Mortgage Payment: $1,200

Add up your monthly debt payments:

$300 (car loan) + $150 (credit card) + $200 (student loan) + $1,200 (mortgage) = $1,850 total monthly debt payments.

Divide total monthly debt payments by your gross monthly income:

$1,850 ÷ $5,000 = 0.37.

Multiply by 100 to get the DTI percentage:

0.37 × 100 = 37% DTI.

With a DTI of 37%, you may still qualify for a loan, as many lenders accept up to 43%, though lower is better for approval chances and favorable terms.

This compares the loan amount to the value of the property you want to buy. Lenders prefer a lower LTV ratio, as it indicates lower risk. An LTV of 80% or lower is ideal, meaning you would need a 20% down payment. However, some lenders may approve loans with a higher LTV if you purchase mortgage insurance.

Formula: (Loan amount ÷ Appraised property value) × 100.

Scenario:

Property Value: $300,000

Down Payment: $60,000

Loan Amount: Property value – Down payment = $300,000 – $60,000 = $240,000

Step-by-Step Calculation:

Divide the loan amount by the property value:

$240,000 ÷ $300,000 = 0.80.

Multiply by 100 to get the LTV percentage:

0.80 × 100 = 80% LTV.

With an 80% LTV, the borrower would likely be eligible for a mortgage, as most lenders prefer an LTV ratio of 80% or lower. If the LTV ratio is higher (e.g., 90%), the borrower may need to pay for private mortgage insurance (PMI) or provide a larger down payment to reduce the lender's risk.

A mortgage pre-approval gives you an estimate of your budget, helping you in the house-hunting process. Pre-approval also helps speed up property acquisition and the home-buying process.

The common challenges applicants face in the mortgage pre-approval process are;

A low credit score and high debt-to-income ratio can result in a higher interest rate or even disqualification from a loan. Before applying, start by reviewing your credit report and disputing any errors. Pay off credit card balances, avoid new debt, and make timely payments to improve your score.

Many lenders prefer a 20% down payment, and falling short of this can make getting approved harder. Look into down payment assistance programs or save more aggressively by cutting non-essential spending. Some lenders also offer loans with lower down payment options, though they may require mortgage protection insurance.

Missing paperwork or errors in submitted documents can delay or even derail the process. Stay organized! Create a checklist of the required documents, such as tax returns, pay stubs, and bank statements, and ensure they are up-to-date and accurate before applying.

After pre-approval, it's time to start house hunting for your dream house with confidence. Your pre-approval shows sellers you're serious and makes you a competitive buyer, so make an offer when you find the right home. Once accepted, the lender will finalize the mortgage application process, conduct an appraisal, and verify details before closing. Get ready to secure your dream house.

The mortgage pre-approval process is crucial in your home-buying journey. Understanding the eligibility criteria, such as Debt-to-Income (DTI) and Loan-to-Value (LTV) ratios, helps you assess your financial readiness.

Awareness of common challenges like low credit scores, high DTI, insufficient down payments, and knowing how to address them can make the process smoother. Once pre-approved, you can confidently start house hunting, knowing you have secure financing.

Seek professional advice from a real estate agent to empower you to navigate the mortgage market and get closer to owning your dream home. An attorney can guide you on the legal fees needed; however, you have to factor in the attorney fees. Let us start your dream home ownership journey today!

Mortgage pre-approval is a lender’s assessment of your financial situation to determine how much they will lend you for a home purchase.

The pre-approval process typically takes a few days to a week, depending on the lender and how quickly you provide the necessary documents.

Preapproval does not guarantee a loan; it is contingent on final underwriting and verifying your financial details and the property.

Common documents include proof of income, tax returns, bank statements, and credit reports. Each lender may have specific requirements.

Webber, M. R. (n.d.). The mortgage process is explained. Investopedia. https://www.investopedia.com/mortgage-process-explained-5213694

Victoria Araj. (2024, April 21). Understanding the mortgage loan process. Rocket Mortgage. https://www.rocketmortgage.com/learn/mortgage-loan-process

Theresa Stevens. (2024, May 31). The mortgage process: A 10-step guide. LendingTree. https://www.lendingtree.com/home/mortgage/mortgage-process/

Stanbic Bank & KMRC partner for affordable housing financing in Kenya. Stanbic Bank & KMRC Partner for Affordable Housing Financing in Kenya | Stanbic Bank Kenya. (2024). https://www.stanbicbank.co.ke/kenya/personal/products-and-services/borrow-for-your-needs/see-all-home-loans/affordable-housing

Nicole.wasuna@kra.go.ke. (2024). Incentives for investors. KRA. https://www.kra.go.ke/ngos/incentives-investors-certificate/investing-in-kenya/incentives-investors